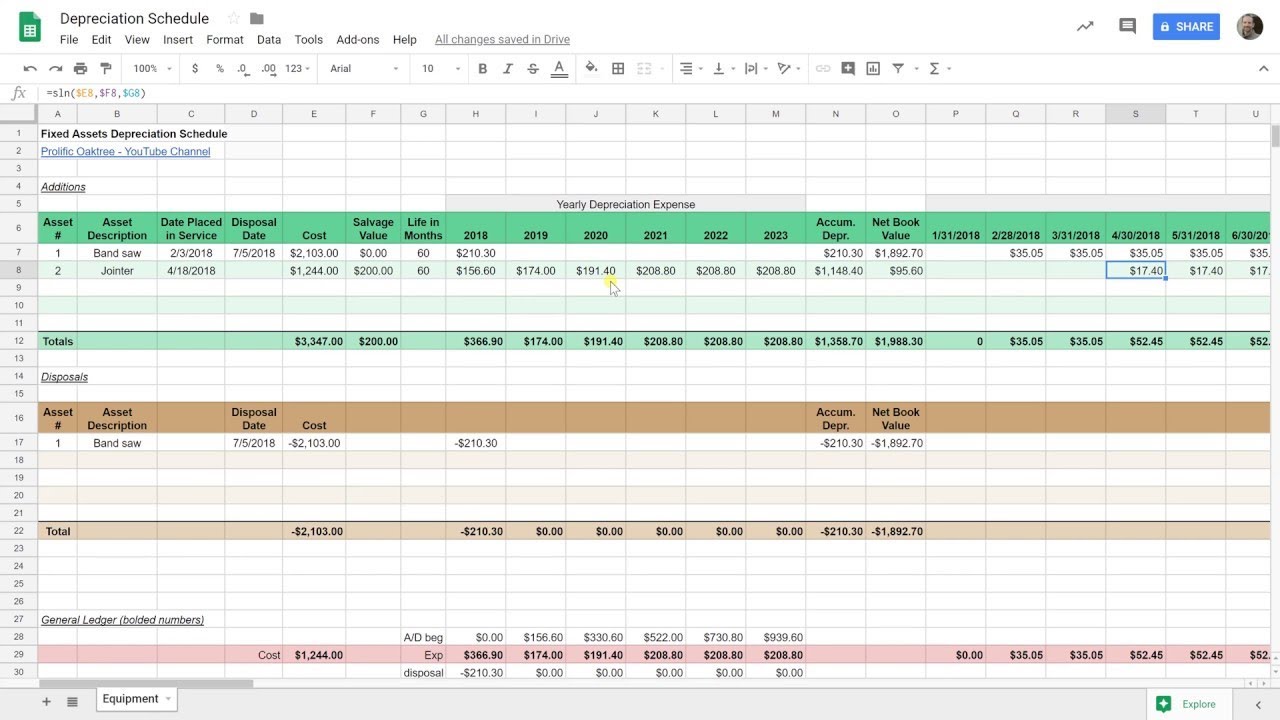

Depreciation spreadsheet example

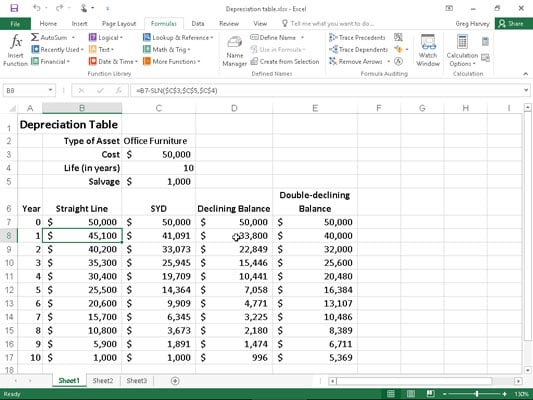

Using the depreciation schedule example above the first item shows depreciation in the first 2 years of 5556 and 16667. We need to define the cost salvage and life arguments for the SLN function.

How To Use Depreciation Functions In Excel 2016 Dummies

For the third year the depreciable cost becomes 360 with a depreciation of 144 and so on.

. An alphabetical listing of all the examples from the Double Entry. And life for this formula is the life in periods of time and is listed in cell C4 in years 5. Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight-line method.

At the end of the current month the balance reaches 10000. A selection of the most recent examples from the Double Entry Bookkeeping Example Guide. These include SLN straight-line SYD sum-of-years digits DDB declining balance with the default being double-declining VDB declining balance with switch to straight-line DB fixed-declining balance AMORDEGRC and AMORLINC.

The average car depreciation rate is 14. The lessor uses residual value as one of. To see how accounts payable is listed on the balance sheet below is an example of Apple Incs balance sheet as of the end of their fiscal year for 2017 from their annual 10K statement.

The residual value of a fixed asset is an estimate of how much it will be worth at the end of its lease or at the end of its useful life. With an Excel inventory template like a fixed asset depreciation calculator warehouse inventory list physical inventory count sheet or home contents inventory list youll have greater control of your assets. Salvage is listed in cell C3 10000.

Excel uses a slightly different formula to calculate the deprecation value for the first and last period the last period represents an 11th year with only 3 months. Suppose that during the previous month your accounts receivable stood at 5000. It is a mixed between a service and merchandising business.

Section 179 deduction dollar limits. Paid Cash on Account Journal Entry. This Excel spreadsheet example can be useful in creating a financial plan for your business.

With this method fixed assets. The declining balance method is a type of accelerated depreciation used to write off depreciation costs earlier in an assets life and to minimize tax exposure. If you set the dividend payment frequency to 12 months and the payment option is set to Subsequent the dividend will be included on the income statement in the last month of the appropriate cash flow projection year and the dividend payable at the end of the financial year and all subsequent months in the new financial year until the.

Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. Fixed Cost Explanation. However if you have claimed vehicle depreciation you may not deduct tolls and parking feesCars used by employees for business use the portion of.

Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc. Updated Study Notes and Revision Kits MASOMO MSINGI PUBLISHERS. It is the most common method of spreading the assets value throughout its life.

Latest Double Entry Bookkeeping Example. A P 1 - R100 n. As the name suggests these costs are variable in nature and changes with the increase or.

For example due to rapid technological advancements a straight line depreciation method may not be suitable for an asset such as a computer. You can calculate set-up costs profit and loss forecast. While the balance sheet can be prepared at any time it is.

There are a number of built-in functions for depreciation calculation in Excel. You can deduct the ordinary and necessary expenses for. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Additional Vehicle Use Deductions. An inventory Excel template for your warehouse can give you specific information about both in-stock items and those on order. In addition to the standard mileage rates you may deduct the costs of tolls and parking while using your vehicle for one of the approved purposes - these are separate deductions.

Another example is a food truck business it produces food to eat but also sell beverage from other companies. A computer would face larger depreciation expenses in its early useful life and smaller depreciation expenses in the later periods of its useful life due to the quick obsolescence of older technology. These expenses may include mortgage interest property tax operating expenses depreciation and repairs.

Suppose for example a business originally purchased an asset for 120000 and at the time decided to use the straight line method of depreciation with an estimated useful life of 10 years and salvage value of zero. Certificate of Deposit in Accounting. D P - A.

This would mean that additional 5000 worth of debtors were not able to pay their dues which will decrease the cash available within the company. I wont be discussing the last 3. The formula for fixed cost can be calculated by using the following steps.

Balance sheet also known as the statement of financial position is a financial statement that shows the assets liabilities and owners equity of a business at a particular dateThe main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. The cost is listed in cell C2 50000. In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease.

The Car Depreciation Calculator uses the following formulae. The depreciation estimate when purchased is calculated as follows. For the second year the depreciable cost is now 600 1000 - 400 depreciation from the previous year and the annual depreciation will be 240 600 x 40.

See the description of the. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022. The book value of an asset is calculated by deducting the accumulated depreciation from the original purchase price.

Sir I have downloaded cos act depreciation calculator 2018-19 while calculating in Additions sheet it is showing negative figures in dep for year 2018-19. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase. In the first year of use the depreciation will be 400 1000 x 40.

The book value is what is reflected as the assets value on the balance sheet. For example set this argument to 9 if you purchase your asset at the beginning of the second quarter in year 1 9 months to go in the first year. Depreciation is wrongly added back to the purchase cost and it is showing wrong figures.

Over time the depreciation of an asset will build up - the total depreciation over a period of time is known as accumulated depreciation. Changes in Depreciation Estimate Example. For example hair saloon is a service business but it sells shampoos conditioners etc where it requires warehouse or inventory system to keep their stocks.

This is perhaps best illustrated through an example. In financial services templates this data includes assets sales income tax deduction depreciation loan instalments etc. For example you sign a 10-year lease to rent your property.

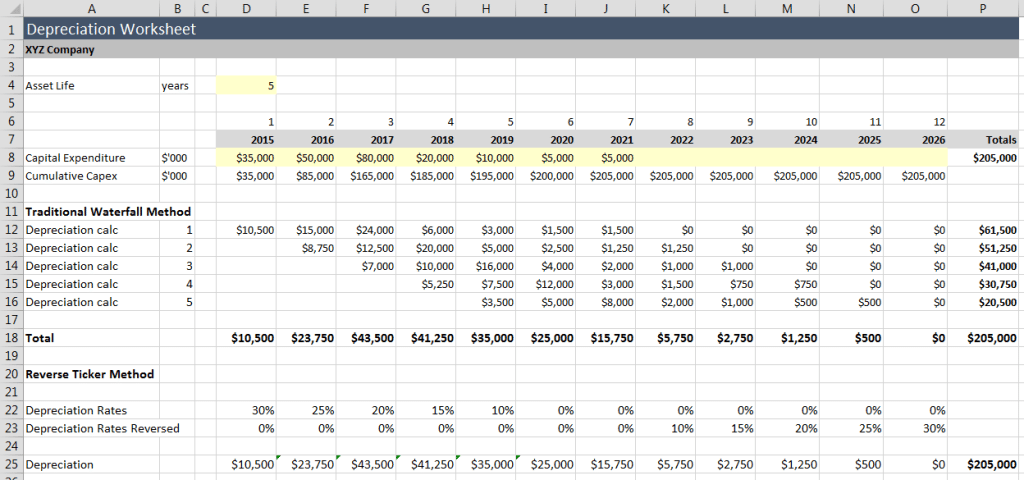

Depreciation In Excel Excel Tutorials Schedule Template Excel

If You Re Not Modelling Depreciation Like This You Re Doing It The Hard Way Access Analytic

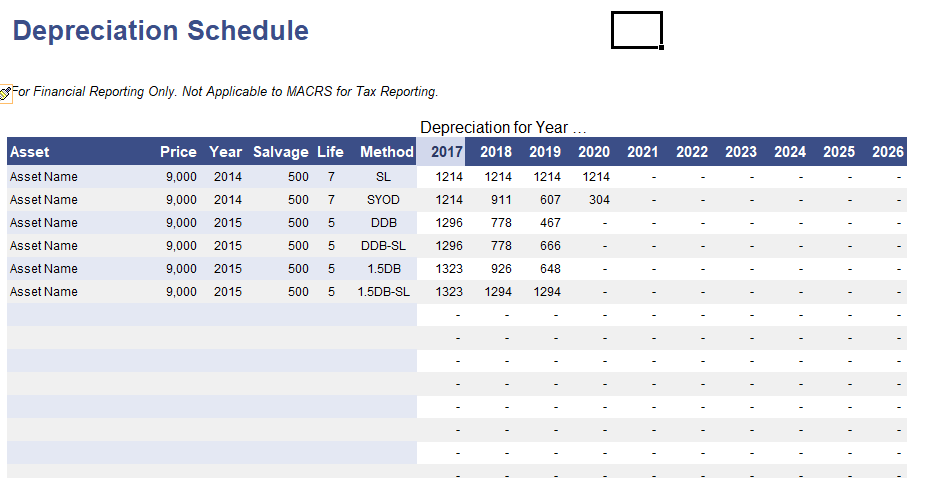

9 Free Depreciation Schedule Templates In Ms Word And Ms Excel

Depreciation Formula Examples With Excel Template

Depreciation Schedule Template For Straight Line And Declining Balance

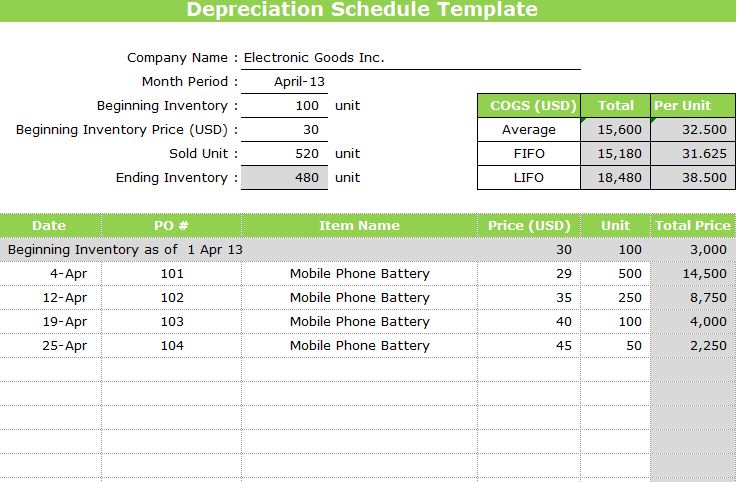

Depreciation Calculator Excel Template For Free Download

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Template Depreciation Schedule Excel

Depreciation Schedule Formula And Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

How To Prepare Depreciation Schedule In Excel Youtube

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Calculator

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Depreciation Schedule Free Depreciation Excel Template

How To Use The Excel Db Function Exceljet